Understanding Medicare

Explore Your Medicare Options

Are you about to turn 65 and about to enroll in Medicare? Or, maybe you’ve already enrolled and are in search of a plan that suits your healthcare needs.

Navigating Medicare can be confusing and overwhelming, but we’re here to help. As an independent Medicare advisor, we specialize in providing personalized guidance and support to help you choose the right plan for your unique needs and budget.

Eligibility

For most people, Medicare eligibility begins at age 65. You must be a US citizen or a permanent resident and you’ve lived in the US continuously for at least five years.

If you are under 65, you are eligible for Medicare under these conditions:

- If you are permanently disabled and you have been receiving Social Security Disability Income (SSDI) benefits for 24 months.

- You have end-stage renal disease.

- You’ve been diagnosed with Amyotrophic Lateral Sclerosis (ALS–also known as Lou Gehrig’s Disease).

Medicare Enrollment Periods

If you are about to become eligible for Medicare, you need to be aware of the different Medicare Enrollment Periods. If you don’t enroll during your Initial Enrollment Period, you may face lifelong penalties and may have a gap in your coverage.

Here are the some of the more common enrollment periods below:

Your Initial Enrollment Period (IEP) begins three months prior to your 65th birthday month and ends three months after your 65th birthday month. (Exception: If your birthday falls on the 1st of the month, your IEP will begin one month early.

During your IEP, you can enroll in Original Medicare (Parts A and B), a Medicare Advantage Plan, or Medicare Part D.

You will automatically be enrolled if:

- You are collecting benefits from Social Security or the Railroad Retirement Board prior to your IEP

- If you have received at least 24 months of disability benefits

- If you suffer from Lou Gehrig’s disease (ALS) or End-Stage Renal Disease (ESRD).

If you do not meet any of the requirements listed above for automatic enrollment, you will need to apply for coverage during your IEP.

Once you’ve enrolled in Original Medicare, you have a six-month open enrollment period for a Medicare Supplement Plan. This enrollment period begins with your Part B effective date and is a one-time election.

If you miss your IEP, there are some potential penalties you may face. *(These only apply of you do not have other credible coverage, such as an employer health plan). Possible penalties are:

- If you don’t enroll in Part B during your IEP, you will pay a late enrollment penalty. This penalty is an extra 10% of your premium for every 12-month period you didn’t have Part B and could have. That 10% is tacked on to your premium every month for as long as you have coverage.

- If you don’t have existing credible drug coverage and don’t enroll in Part D during your IEP, you will have a late enrollment penalty of an extra 1% of your premium for as long as you have coverage.

- If you don’t qualify for premium-free Part A, and don’t enroll during your IEP, you will pay an extra 10% of your premium for twice the number of years you didn’t have coverage.

Once your IEP ends, you can only sign up for Part B and premium-free Part A during one of the other enrollment periods.

The General Enrollment Period, (sometimes referred to as the Annual Open Enrollment Period) occurs each year from January 1 to March 31.

The Annual Enrollment Period (AEP) is every year from October 15 to December 7th. During this time, you can change your existing Medicare coverage. You can:

- Switch from Original Medicare to a Medicare Advantage Plan

- Switch from a Medicare Advantage plan to Original Medicare

- Switch from a Medicare Advantage plan without Prescription drug coverage to anther Medicare Advantage plan that does cover, or prescription drugs visa versa

- Switch from

Special Enrollment Periods (SEP) are available to those that meet certain circumstances to apply outside of the IEP, GEP or AEP.

SEPs are geared towards working individuals. You may apply for Medicare under an SEP if if you work beyond age 65 and have employer-provided health coverage that you would like to continue instead of Medicare. You can delay your Medicare enrollment without penalty.

You also have an 8-month SEP to sign up for Original Medicare the month after your employment ends, thus ending your work health plan. If you also want to apply for Medicare Advantage and Part D, you have 63 days after your employer coverage ends to do so.

Another SEP example would be if you move outside of a plan’s service area. This would trigger a two-month enrollment period in which you could switch to a new Medicare Advantage or Part D prescription drug plan. You could also return to Original Medicare without penalty. Sometimes, you can also enroll into a Medicare Supplement plan.

There are other unique situations in which you may also be eligible for an SEP. You are welcome to contact us to learn what options are available for you.

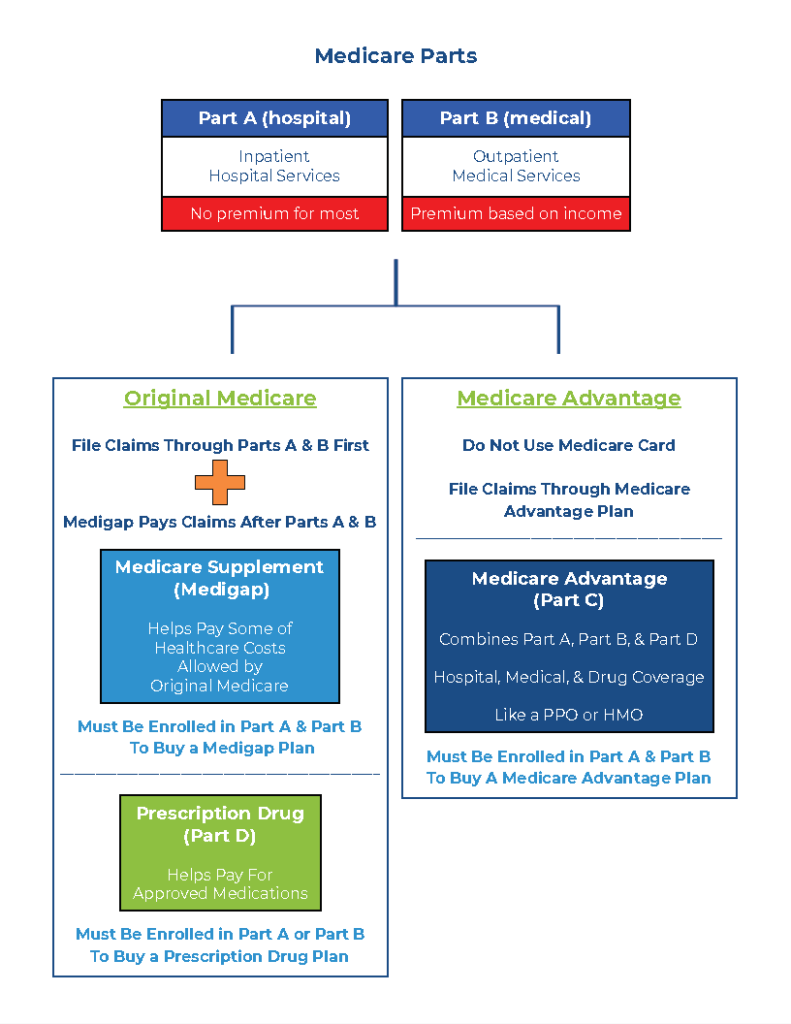

The Parts of Medicare

Medicare is a government-funded health insurance program that provides coverage for people over 65, people with certain disabilities, and people with end-stage renal disease. Medicare is divided into several parts, each covering different healthcare needs. Medicare is made up of four parts. But at any given time, you will only use either Part A, Part B, and Part D OR you will be using Part C. Here is a breakdown of the Parts of Medicare:

- Part A: Hospital insurance that covers inpatient care in hospitals, hospice care, and skilled nursing facilities.

- Part B: Medical insurance that covers outpatient care, doctor visits, and preventive services.

- Part C: Medicare Advantage Plans, which are offered by private insurance companies and provide all the benefits of Parts A and B, plus additional benefits like vision and dental.

- Part D: Prescription drug coverage that helps pay for the cost of prescription drugs

How Will You Get Your Coverge?

Original Medicare is Medicare Part A and Part B, which provides coverage for your inpatient and outpatient medical services.

Medicare Advantage Plans are healthcare plans provided by insurance companies contracted with Medicare to fulfill the same coverage as Original Medicare, but provide additional benefits.

Also known as Medigap, Medicare Supplement plans help to cover the healthcare costs left behind by Original Medicare. With a supplement plan, you can keep your Original Medicare coverage.

Also known as Medicare Part D, these plans are offered by private insurance companies and provide coverage for prescription drugs.

Click on the button below to have an agent reach out to you regarding your Medicare Plan options.

We’ll be in touch within 24 hours.